September 28th, 2022 - Market Update

Current position: Carefully Floating

Stocks and Mortgage Bonds are both higher to start the day. Mortgage Bonds appear to have found a bottom after a move lower on Monday and have had a two-day rally so far, which is something we have not seen in quite some time.

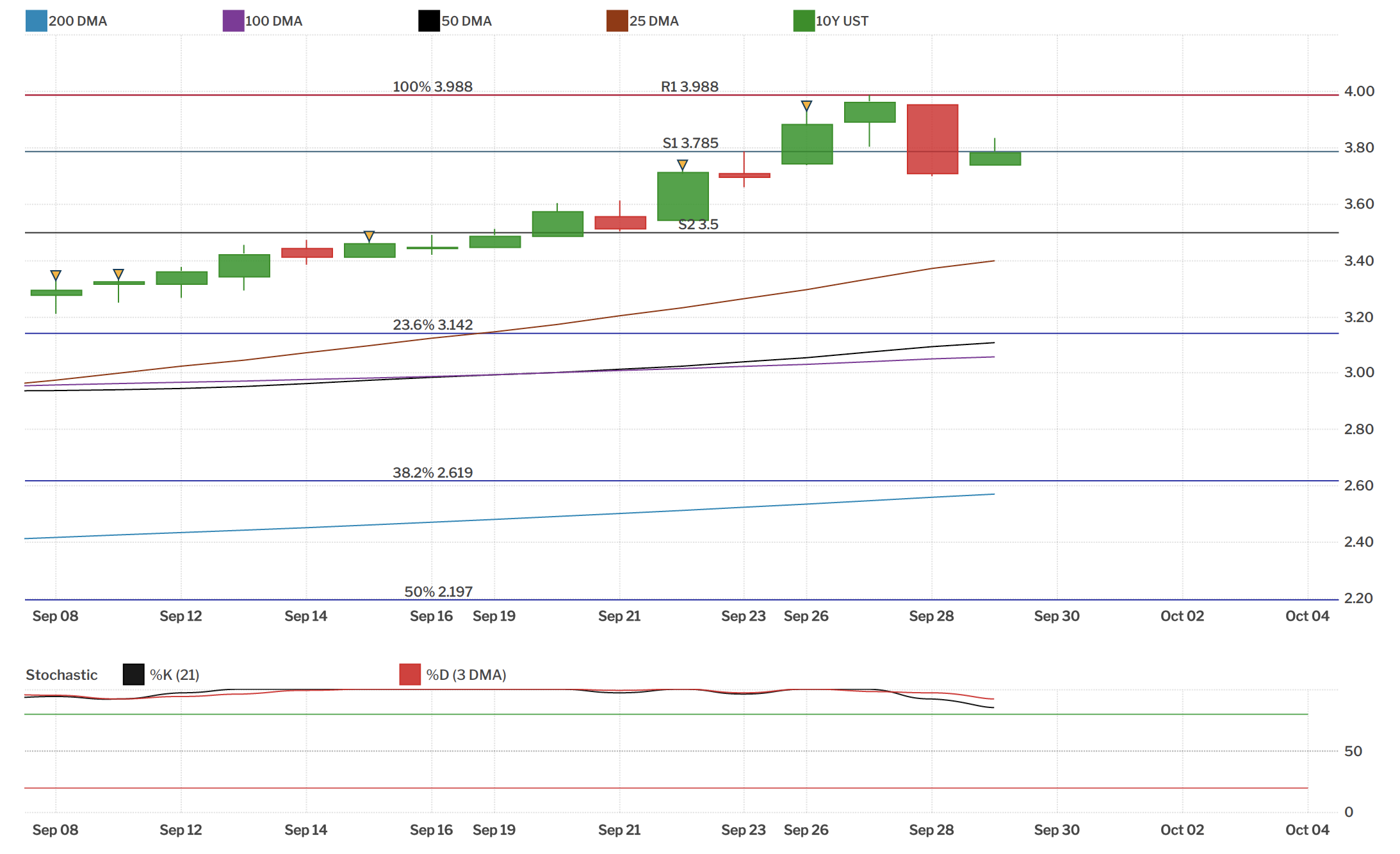

The 10- year, after testing 4%, is now back down to 3.82%. The 1-year Treasury, which is a risk-free investment, is now just over 4%. which is a pretty attractive 1-year return. After the Fed hikes 75bp in November, this could closer to 4.5%, which is something to consider.

The UK has seen their pound drop significantly and 10-year Bond (Gilt) rise to the highest yield in 15 years. Causing this was an announced new mini-budget, which includes unfunded tax cuts. This has drawn sharp criticism from the IMF and Moody's, which has threatened to reduce their credit rating. As a result, there has been a sharp selloff in their longer dated Bonds.

Prior to this news, they were planning on selling 10-year Gilts and continue hiking rates, as they are well behind on curbing inflation. Now, they are going to try to "restore market functioning" and carry out temporary purchases of long dated UK government Bonds, staring today. The purchases will be carried out on whatever scale is necessary to effect this outcome.

They plan to push back their sale of Gilts until October 31. So the UK wants to tighten and sell Bonds, but is going to purchase additional 10-year Gilts, only to begin selling them next month. Peter Boockvar believes that if the US continues to see this volatility and violence of bond moves, they may not get very far with QT, let alone much more with rate hikes.

The announcement of a new QE buying program from the UK has pushed their 10-year yields 40bp lower, and since yields are interconnected around the world, it is helping our 10-year move sharply lower today.

Pending Home Sales, which measures signed contracts on existing homes, fell 2% in August, which was in line with expectations. Sales are now down 24% year over year. The NAR Chief Economist, Lawrence Yun, sees Mortgage Rates rising to near 7%, but when inflation comes down, mortgage rates will begin to improve, as we have been saying. Come November, when we receive the October inflation data, we believe inflation will begin to drop more significantly. Yun also believes that home prices will finish the year up 10% and that sales will pick up a bit in quarter four.

Apartment List released its October National Rent Report, and it showed a 0.2% drop in rents in the month, which is the first decline this year. The timing of this slight dip in rents is consistent with a seasonal trend that was typical in pre-pandemic years. Rents are now up 7.5% year over year.

Mortgage Bonds appear to have found a bottom. They are sharply higher, and are in a new range between support at 97 and overhead resistance at 98.65, which means there is still quite a bit of room to the upside should the rally continue. The 10-year, after touching 4%, is backdown to 3.76%, breaking beneath support at 3.78%. Yields have room to improve until about 3.50%, which would be welcome.

Continue carefully floating

Source: MBS Highway

Join our Watchlist

Our Watchlist is a free service we offer to ensure you never miss an opportunity to lower your interest rate. There is no obligation associated with joining.

We’ll track rates and market conditions on your behalf, and reach out when we see an opportunity to save you money.

Questions?

Reach out any time. We’re here to help you find the best mortgage program for your unique conditions.

Contact us:

847-634-2252

info@longgrovemortgage.com

Or start an application.